TRX Price Prediction: Bullish Technicals and Market Expansion Signal Growth Potential

#TRX

- TRX trading above 20-day moving average indicates bullish technical momentum

- Expansion into Asian markets following Latin American success provides growth catalyst

- Strong stablecoin activity and defiance against market downtrend support price resilience

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Moving Average

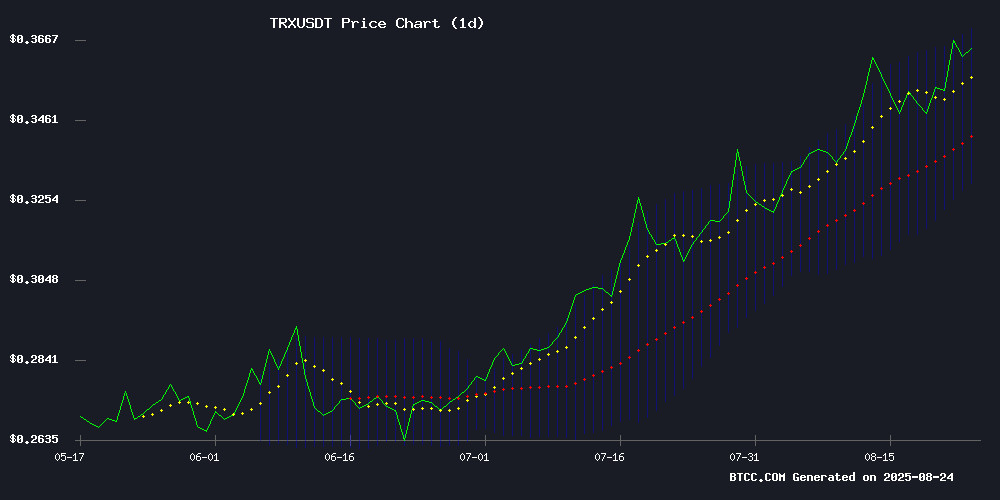

TRX is currently trading at $0.3672, positioned above its 20-day moving average of $0.3497, indicating underlying strength. The MACD histogram reading of -0.001055 shows bearish momentum is weakening, while the price trading NEAR the upper Bollinger Band at $0.3701 suggests potential resistance ahead. According to BTCC financial analyst William, 'The technical configuration supports a bullish outlook with the price holding above the moving average and approaching key resistance levels.'

Market Sentiment: TRX Gains Momentum Amid Regional Expansion

Positive news FLOW surrounding TRON's expansion into Asian markets following its Latin American dominance is bolstering investor confidence. The defiance against broader market downtrends, supported by growing stablecoin activity, creates a favorable sentiment backdrop. BTCC financial analyst William notes, 'The combination of technical strength and fundamental developments positions TRX for potential upward movement toward the $0.40 target level.'

Factors Influencing TRX's Price

Tron Eyes Bigger Market Share In Asia After Securing Dominance In Latin America

Tron's network is cementing its position as a dominant force in stablecoin transactions, particularly in Latin America. USDT transfers on the Tron blockchain have become the preferred method in key South American markets like Brazil, Argentina, and Colombia. The network's influence isn't confined to one region—U.S. spot volumes currently lead globally.

Asia emerges as Tron's next frontier, with trading activity concentrated in East Asian hubs like Hong Kong and South Korea. This expansion coincides with shifting regulatory winds in China, where authorities appear to be reevaluating their stance on stablecoins. The network's growing adoption mirrors broader cryptocurrency sentiment recovery across Asian markets.

TRX Defies Market Downtrend as Stablecoin Activity Bolsters Resistance

Tron's TRX token demonstrates unusual resilience amid a broader cryptocurrency sell-off, declining less than 1% while Bitcoin and Ethereum shed over 5% this week. The asset's eight-week bullish streak now faces its first serious test.

TRX's stability stems from its entrenched position as the leading network for USDT transactions. Record profitability among holders and robust stablecoin demand create a natural buffer against market volatility. This structural advantage allows TRX to frequently decouple from prevailing market trends.

Network metrics reveal the depth of TRON's stablecoin dominance. As the preferred chain for USDT settlements, TRX benefits from constant transactional demand that sustains its valuation. Such organic utility continues to outweigh episodic sell pressure from profit-taking.

TRX Price Prediction: TRON Eyes $0.40 Target as Technical Indicators Signal Continued Bullish Momentum

TRON (TRX) is trading near its 52-week high of $0.37, with technical indicators suggesting further upside potential. Analysts predict a breakout toward $0.40 within 4-6 weeks if resistance at $0.37 is breached. The Relative Strength Index (RSI) at 67.44 reinforces bullish sentiment, while support holds firm at $0.33.

Market consensus leans increasingly optimistic, with CoinLore revising its short-term target upward from $0.343 to $0.3519 this week. TRX's price action remains confined within a $0.35-$0.42 range, though technical setups favor movement toward the upper boundary. The Bollinger Band configuration highlights $0.33 as critical support should volatility intensify.

Is TRX a good investment?

Based on current technical indicators and market developments, TRX presents a compelling investment opportunity. The price trading above the 20-day moving average combined with weakening bearish momentum on the MACD suggests underlying strength. Additionally, TRON's strategic expansion into new markets and growing stablecoin activity provide fundamental support.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.3672 | Above MA Support |

| 20-day MA | $0.3497 | Bullish |

| MACD Histogram | -0.001055 | Bearish Momentum Weakening |

| Bollinger Upper | $0.3701 | Near Resistance |

While the proximity to upper Bollinger Band resistance suggests potential near-term consolidation, the overall technical and fundamental picture supports a positive outlook for TRX investors.